Forecast Your Cash Flow. Get Paid Faster.

Know exactly what's safe to spend — today and for the next 365 days. The only cash flow calendar with built-in invoicing: send invoices, collect payments, and watch expected income appear in your forecast automatically.

Set up in 3 minutes • No credit card • Free forever plan

Already have an account? Log in

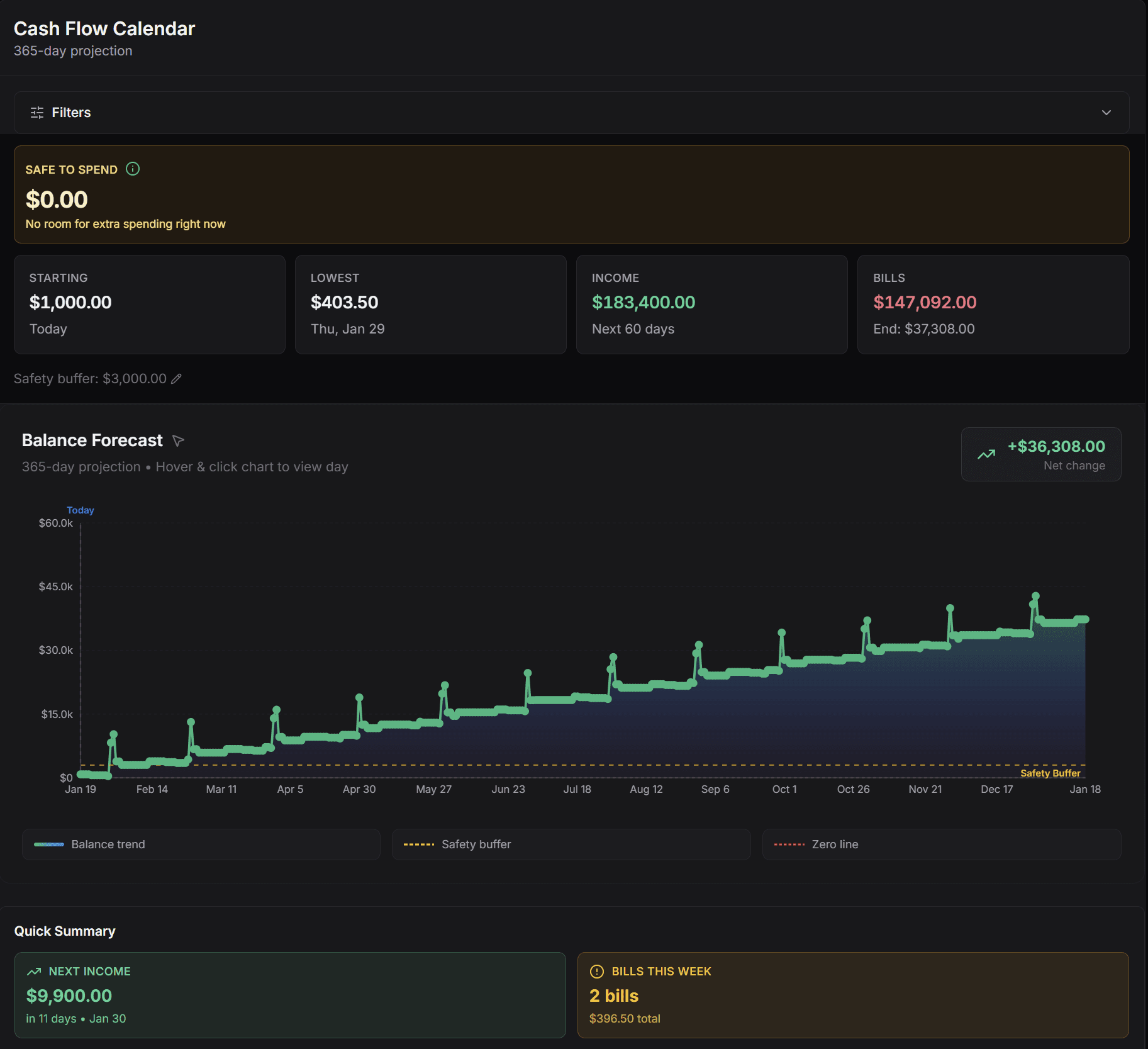

Without going below your $200.00 buffer

Starting

$1,000

Today

Lowest

$403.50

Thu, Jan 29

Income

$183K

Next 90 days

Bills

$147K

End: $37K

Balance Forecast

365-day projection

+$36,346.20

Net change

January 2026

Built for the 47% of freelancers who say income instability is their #1 financial worry.

The only cash flow app where invoicing updates your forecast

Other apps make you track invoices separately. We connect them: send an invoice, and expected income instantly appears in your cash flow calendar. When it's paid, your forecast updates automatically. Forecast + Get Paid — in one place.

How it works

A simple 4-step flow to get clarity on what's safe to spend—today and up to a year from now.

Add Your Accounts

Enter your checking and savings balances to set your starting point.

Enter Your Bills

Add one-time or recurring bills and income.

See Your Future

Get up to a 365-day projection with interactive charts and filters.

Stay Informed

Get weekly digests and alerts delivered to your inbox.

Most users are set up in under 3 minutes

Forecast + Get Paid — in one place

Most cash flow apps stop at forecasting. We go further: built-in invoicing that syncs with your forecast, so you always know what's coming in and when.

Safe to Spend

Core FeatureOne number that answers: "Can I afford this?" Your Safe to Spend amount is calculated from your lowest projected balance over the next 14 days, minus your safety buffer. No more guessing.

- Safe to Spend indicator — always visible at the top

- Interactive 365-day balance forecast chart

- Low balance alerts when you need them

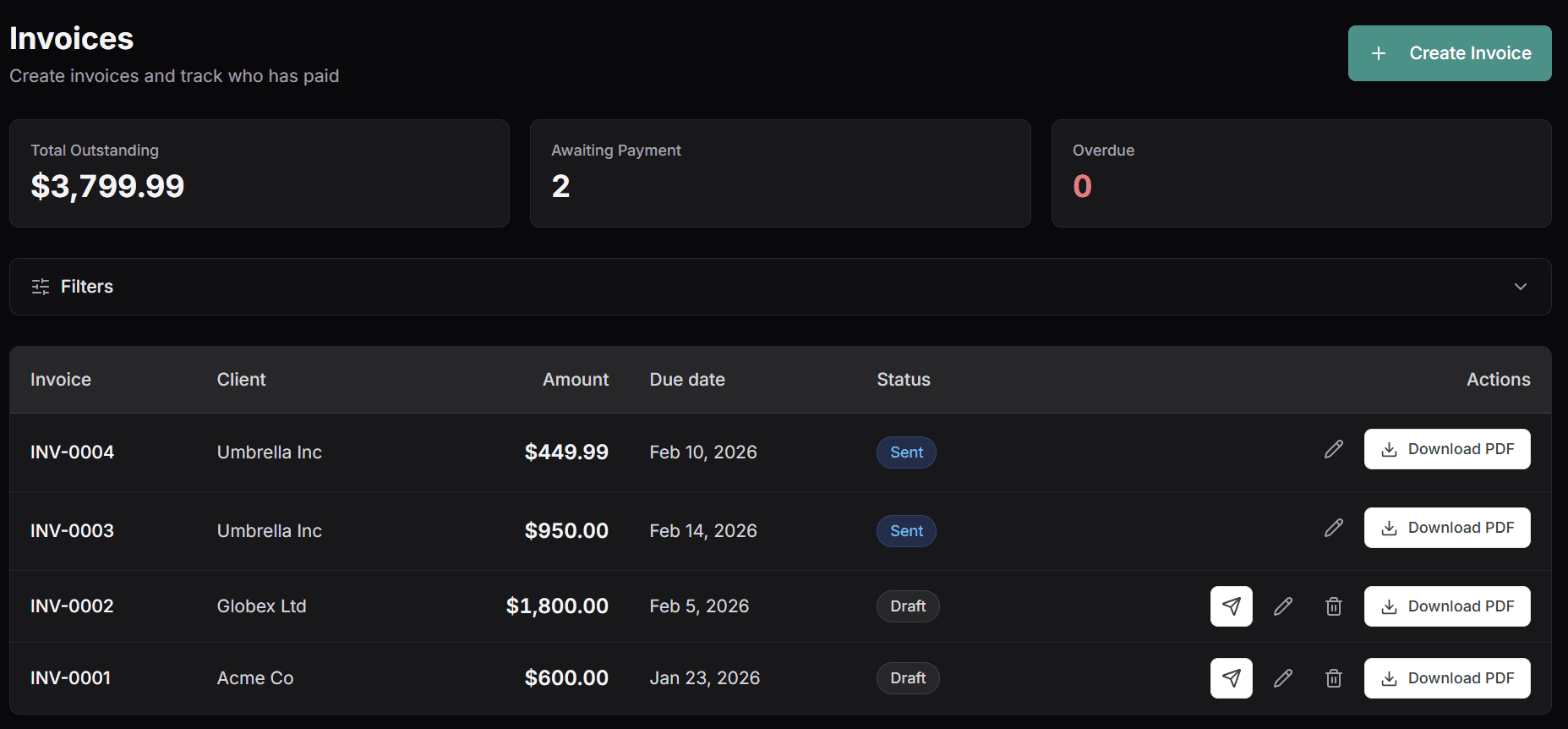

Get Paid Faster

Runway CollectUnique FeatureThis is what makes us different: Send quotes, convert to invoices, and get paid—all while your forecast updates automatically. The moment you send an invoice, expected income appears in your cash flow calendar. When it's paid, your balance updates. No other cash flow app does this.

- Invoice → Forecast sync — send invoice, income appears in forecast instantly

- Payment → Balance sync — when paid, your cash flow updates automatically

- One-click payments — clients pay instantly via Stripe

- Professional quotes that convert to invoices

- Automated payment reminders (3 escalating templates)

Never Get Blindsided

Monday morning clarity. See your week's cash flow, get warned about bill pile-ups, and start the week knowing exactly where you stand.

- Weekly email digest

- Bill collision alerts

- Upcoming expense warnings

Bill collision detected

Thu: Rent + Car Insurance land on the same day.

Save for Taxes Automatically

Set your tax rate, track quarterly estimated payments, and see your after-tax "safe to spend" amount. Never get surprised by tax season again.

- After-tax income calculator

- Quarterly tax deadline tracking

- Tax savings progress bar

Total Income

$48,000

After-Tax

$36,000

$3,500 remaining to save

Q4 deadline in 28 days

$3,000 estimated tax due by January 15

More ways we help

Quick what-ifs and fast setup—so you can get answers without rebuilding your whole budget.

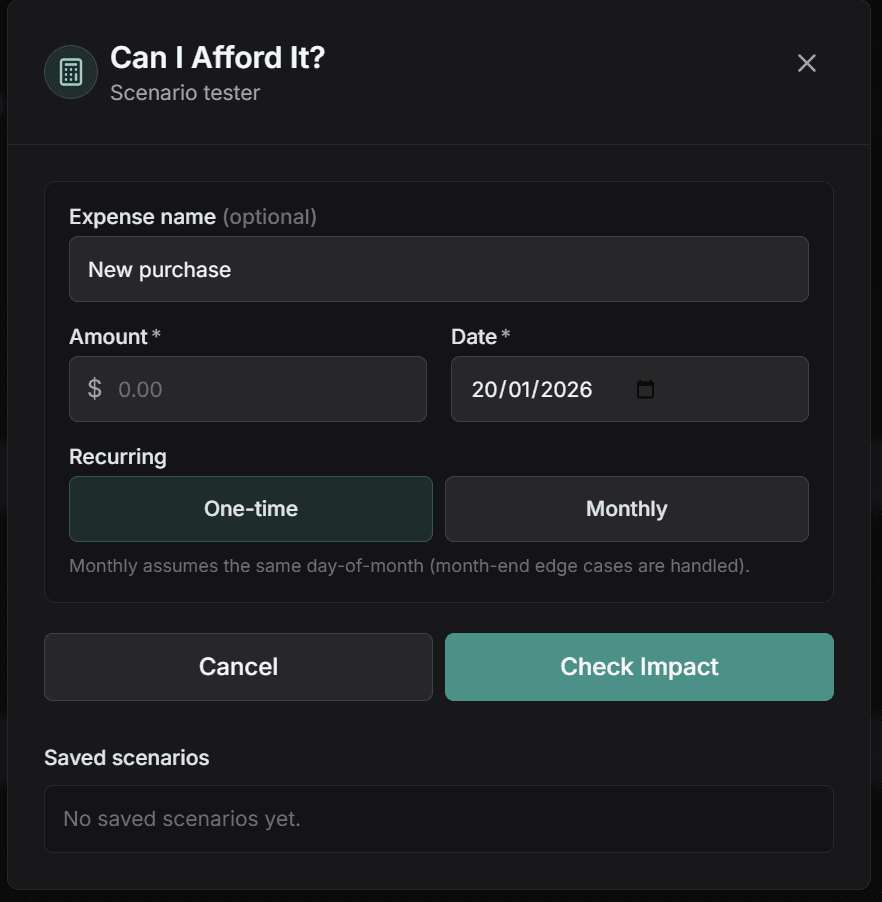

Can I Afford It?

Test a hypothetical expense and instantly see how it affects your cash flow forecast.

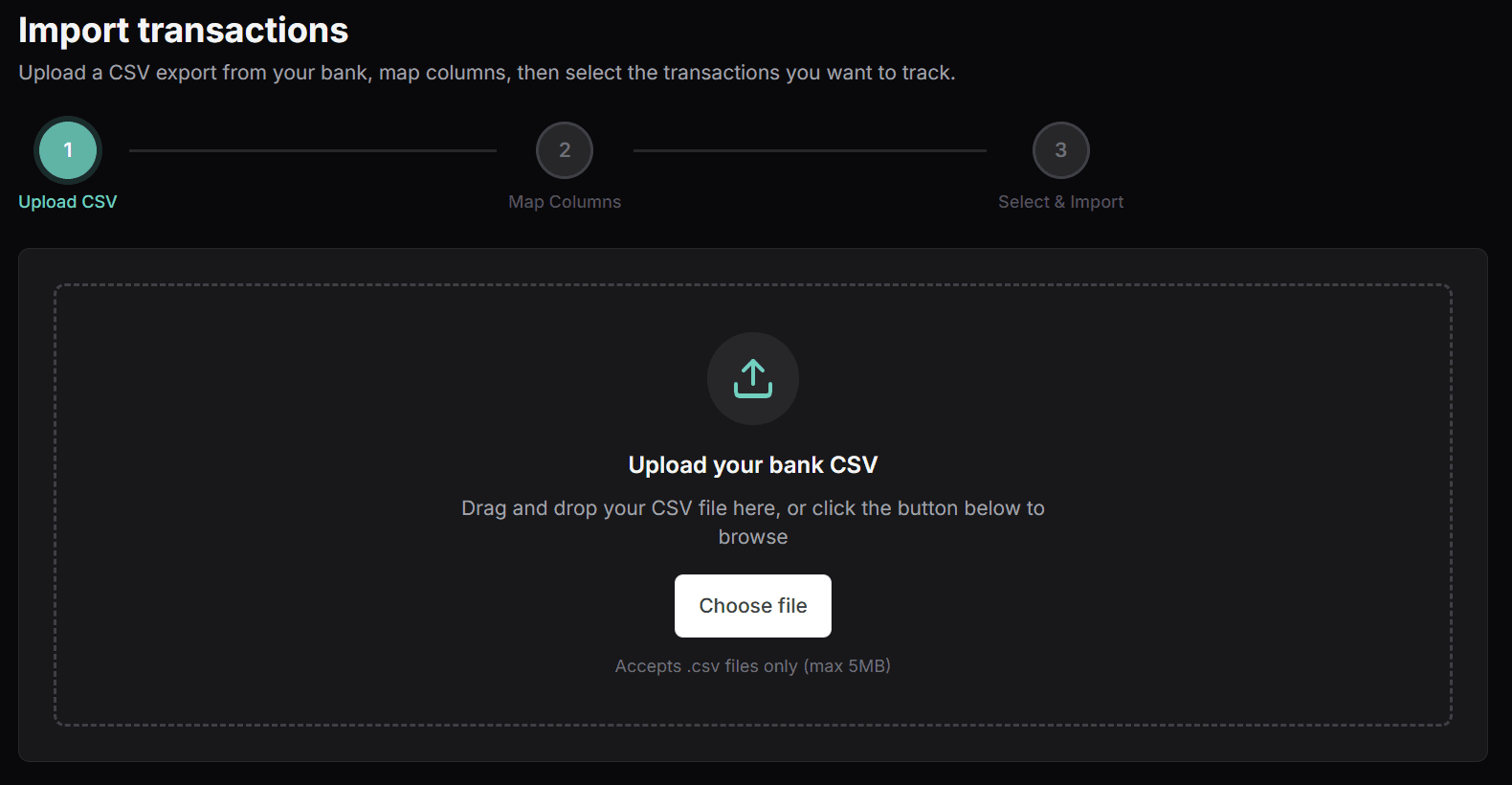

Import from YNAB or your bank

Upload CSV or Excel files (.xlsx, .xls). Smart import detects recurring patterns and creates recurring bills automatically—no manual setup required.

Emergency Fund Tracker

Set a savings goal and track your progress. See how much runway you have if income stops.

3.2 months of runway at current spending

Credit Card Cash Flow Forecasting

See credit card payments in your cash flow calendar. Track utilization, simulate payment scenarios, and know exactly how charges today affect your balance tomorrow.

- Credit utilization tracking with color-coded warnings

- Payment due dates appear in your forecast

- Payment simulator: compare min, statement, or custom amounts

Debt Payoff Planner

Compare Snowball vs Avalanche payoff strategies. See exactly when you'll be debt-free and how much interest you'll save with extra payments.

- Side-by-side strategy comparison

- Extra payment impact calculator

- Visual payoff timeline with milestones

Built for freelancers who are tired of guessing

Cash Flow Forecaster is the most reliable cash flow forecasting system for anyone whose income doesn't arrive on the 1st and 15th like clockwork.

Graphic Designers

Waiting on client approvals and Net-30 payments

Freelance Writers

Juggling multiple clients with different payment schedules

Marketing Consultants

Managing retainers and project-based work

Web Developers

Balancing milestone payments across projects

Not built for: Businesses with full-time bookkeepers or anyone who needs complex accounting. We keep it simple on purpose.

Ready to forecast your cash flow and get paid faster?

See your cash flow calendar in minutes. Send your first invoice today. No credit card, no commitment.

Forecast + Get Paid. One simple price.

Start free. Upgrade to Pro for invoicing that syncs with your forecast, longer projections, and priority support.

Free

For getting clarity fast

$0/forever

90-day cash flow forecast

Weekly Email Digest

Bill Collision Alerts

Low Balance Alerts

CSV & Excel Import

CSV Export

Up to 10 bills & income sources

Basic calendar view

Email support (48hr)

No credit card required

Pro

Forecast + Get Paid — all in one

$7.99/month

Everything in Free

365-day forecast (12 months ahead)

Invoice → Forecast sync (unique feature)

Runway Collect: Quotes & Invoices

One-click Stripe payments for invoices

Generate & download PDF quotes & invoices

Custom invoice branding (logo + business name)

Reports & Export (Excel, JSON, CSV)

Credit card tracking & debt payoff planner

Unlimited bills & income sources

Priority support (24hr)

Cancel anytime during trial

Cancel anytime • 14-day money-back guarantee • No credit card required for free tier

Lifetime Deal — Pay Once, Use Forever

Get permanent Pro access with a single payment. No monthly fees, no renewals, all future updates included.

- Everything in Pro

- One-time payment

- Lifetime access

- All future updates

Secure payment via Stripe • 30-day money-back guarantee

Frequently Asked Questions

Everything you need to know about forecasting your cash flow and taking control of your finances.

A cash flow calendar is a visual tool that maps your expected income (like invoices, paychecks, or client payments) and upcoming bills onto specific dates. Unlike a traditional budget that shows monthly totals, a cash flow calendar shows your projected bank balance day-by-day. This helps you spot low-balance days before they happen, see when multiple bills land on the same day (bill collisions), and know exactly what's safe to spend. Also known as: bill calendar, payment calendar, balance forecast, income calendar.

Safe to Spend is the maximum amount you can spend today without risking an overdraft in the next 14 days. It's calculated by taking your lowest projected balance over the next two weeks and subtracting your safety buffer. For example, if your lowest upcoming balance will be $2,500 and your buffer is $500, your Safe to Spend is $2,000. This gives freelancers with irregular income a clear, single number that answers 'Can I afford this?' without guessing. Also known as: available balance, spendable amount, discretionary income.

Cash Flow Forecaster uses a simple but powerful algorithm. You enter your current account balance, recurring income (with frequencies like weekly, bi-weekly, or monthly), and recurring bills with their due dates. The app then projects your balance day-by-day—up to 90 days on Free, or a full 365 days on Pro—showing you exactly when money comes in and goes out. It's like having a financial crystal ball that answers 'Will I have enough on the 15th?' with precision.

Every week, you'll receive an email summarizing your upcoming cash flow: total income expected, bills due, your lowest balance day, and any alerts like bill collisions or overdraft risks. You can customize which day and time you receive it in your settings.

Traditional budgeting apps like Mint and YNAB focus on tracking where your money went—they're backward-looking. Cash Flow Forecaster is forward-looking. Instead of categorizing past expenses, we show you your projected daily balance for up to a full year ahead. The calendar interface answers the real question freelancers have: 'Can I afford this expense before my next paycheck arrives?' Plus, our 'Can I Afford It?' feature lets you test hypothetical purchases and see exactly how they'd impact your future balance.

Yes! We have a dedicated YNAB importer that auto-detects your export format—just upload your CSV or Excel file and we'll handle the rest. The importer recognizes both YNAB's basic export and register export formats. Our smart import feature detects recurring patterns in your transactions and can automatically create recurring bills and income sources—so you don't have to manually enter each one. For Mint users, our generic importer works great with Mint exports. Either way, you can be up and running with your recurring entries set up in minutes. Find the import tools in your dashboard under Import Transactions.

Absolutely. Your data is protected with enterprise-grade security. We use Supabase with Row Level Security (RLS), meaning your data is completely isolated and only accessible by you. All connections are encrypted with SSL, and we never store sensitive payment information—that's handled securely by Stripe. We don't sell your data, and you can delete your account and all associated data at any time.

The Free plan gives you the core experience: up to 10 bills, 10 income sources, 90-day forecast, CSV & Excel import, and CSV export. Pro ($7.99/month) unlocks unlimited bills and income sources, extends your forecast to a full year (365 days), adds full Reports & Export with Excel and JSON formats (Monthly Summary, Category Spending, Cash Forecast reports), credit card tracking with debt payoff planner, and includes Runway Collect—our professional invoicing feature with PDF generation and automated payment reminders.

Yes! For $99 one-time, you get permanent Pro access with no monthly fees ever. This includes all Pro features (365-day forecast, unlimited bills/income, Runway Collect invoicing, Excel/JSON exports) plus all future updates. It's perfect if you prefer to pay once rather than subscribe. You'll save 37% compared to paying for 2 years of Pro (yearly). The lifetime deal is available on our pricing page.

Bank sync is coming soon! Currently, Cash Flow Forecaster works with manual entry, which many freelancers actually prefer—it gives you full control and awareness of your finances. You enter your starting balance once, then add your recurring income and bills. The calendar updates automatically. When bank sync launches, it will be optional, not required.

Yes! Cash Flow Forecaster offers credit card cash flow forecasting—a feature most competitors don't have. Add your credit cards with their limits, APR, and payment due dates. You'll see: credit utilization tracking with color-coded warnings (green under 30%, amber 30-50%, red over 50%), payment due dates appearing in your cash flow calendar, a payment simulator to compare minimum payment vs statement balance vs custom amounts, and interest cost projections. For users with multiple cards, our Debt Payoff Planner compares Snowball vs Avalanche strategies to help you become debt-free faster.

The Debt Payoff Planner helps you create a strategy to become debt-free. Add your credit cards or loans with their balances, interest rates (APR), and minimum payments. The planner then compares two proven strategies: Snowball (pay off smallest balances first for quick wins) vs Avalanche (pay off highest interest rates first to save money). You'll see a side-by-side comparison showing total interest paid, payoff timeline, and monthly payment schedules. You can also simulate extra payments to see how paying an extra $50 or $100 per month accelerates your debt-free date and reduces total interest.

Yes! Cash Flow Forecaster supports both CSV and Excel file imports (.xlsx, .xls). Just drag and drop your bank statement or transaction export into the import page. Our smart column detection automatically identifies date, description, and amount columns—no manual mapping required. The importer also detects recurring transactions and can create recurring bills or income sources from your import. This works great for bank exports, credit card statements, or even your own Excel budget spreadsheets.

We built this for freelancers, gig workers, and anyone with irregular income. If you've ever wondered 'Can I pay rent on the 1st?' or 'Am I safe until my next invoice pays?', this is for you. Traditional budgeting apps assume you get a steady paycheck on the 1st and 15th—we don't. Great fit for graphic designers, freelance writers, marketing consultants, web developers, and side-gig hustlers. Not built for complex accounting or businesses with full-time bookkeepers—we keep it simple on purpose.

Runway Collect is our built-in invoicing system for Pro users. Create professional invoices, generate PDFs, and email them directly to clients—from your dashboard. When you create an invoice, it automatically appears as expected income in your cash flow forecast. You can also send payment reminders (friendly, firm, or final) to chase down late payments. It's invoicing that actually connects to your cash flow planning.

With Runway Collect, each invoice includes a secure Stripe payment link. Your client clicks 'Pay Now', enters their card details on Stripe's hosted checkout page, and the payment goes directly to your connected Stripe account. You can also add your logo and business name to invoices for a professional look. When they pay, the invoice status updates automatically and syncs with your forecast—no manual tracking required.

Yes! Our Free tier is fully functional—not a limited trial. You get 10 bills, 10 income sources, 90-day forecasting, and the 'Can I Afford It?' scenario tester. If you want unlimited entries, a longer forecast, or invoicing (Runway Collect), you can upgrade anytime. There's no credit card required to sign up.

Budgeting with irregular income requires a different approach than traditional monthly budgets. First, calculate your baseline expenses—the minimum you need each month for rent, utilities, insurance, and essentials. Second, build a buffer fund of 2-3 months of expenses to smooth out income fluctuations. Third, use a cash flow calendar (not a monthly budget) to see your projected balance day-by-day. Finally, pay yourself a consistent 'salary' from your business income rather than spending whatever comes in. Cash Flow Forecaster automates the cash flow calendar part, showing you exactly when you'll run low and what's safe to spend.

Yes! Cash Flow Forecaster includes a full Reports & Export feature. Free users can export their data to CSV format, which opens in Excel, Google Sheets, or Numbers. Pro users unlock Excel and JSON export formats, plus access to all report types including Cash Forecast and complete data backups. You can export quick reports like Monthly Summary or Category Spending with one click, or use the Custom Export Builder to select exactly what data you want, choose a date range, and pick your preferred format. Your export history is saved for 30 days so you can re-download previous exports.

The Reports page offers four quick reports: Monthly Summary (income vs expenses with net cash flow), Category Spending (breakdown by bill category with percentages), Cash Forecast (daily projected balances—Pro only), and All Data (complete backup of your accounts, bills, income, and invoices—Pro only). You can also use the Custom Export Builder to create tailored exports by selecting specific data types, date ranges, and formats. All reports can be exported to CSV (free) or Excel/JSON (Pro).

Cash flow forecasting is predicting your future bank balance based on known income and expenses. For freelancers, this means projecting when invoices will be paid, when bills are due, and what your balance will be on any given day. A good cash flow forecast helps you avoid overdrafts, plan large purchases, and manage irregular income. Unlike monthly budgets that hide timing problems, a day-by-day cash flow forecast reveals exactly when you'll run low—before it happens. Also known as: balance projection, cash projection, liquidity forecast.

Still have questions?

Contact our support teamReady to forecast and get paid — in one place?

Join freelancers who see their future cash flow, send invoices, and collect payments — all without switching apps.